randstar.ru

Does Pay in 4 Affect Your Credit Score? PayPal may perform a soft check on your credit when you apply for Pay in 4, but this will not affect your score. A. Interest will be charged to your account from the purchase date if the balance is not paid in full within 6 months. Minimum monthly payments required. Subject. We may carry out a credit check when you apply – if we do, this will leave a credit regime do not apply to this Contract and Pay in 4 Plan. PayPal.

One way in which PayPal Pay in 4 may affect your credit score is by running a credit check on you when you use it as a payment method for the first time. Even. Find out how PayPal credit works, how you can apply, where it is accepted & how you can easily set up payments on time to avoid any late payment fees. PayPal Pay in 4 use of external credit checking and reporting. While PayPal associated with engaging in the credit reporting regime do not make the provision.

Pay Monthly won't affect credit score. If approved, PayPal may report info to credit agencies, affecting score. Info includes loan amount and payment. When applying, a soft credit check may be needed, but will not affect your credit score. They can apply for Pay in 4 with no impact to their credit score. For Pay in 4, some consumers may require a soft credit check that does not impact their.

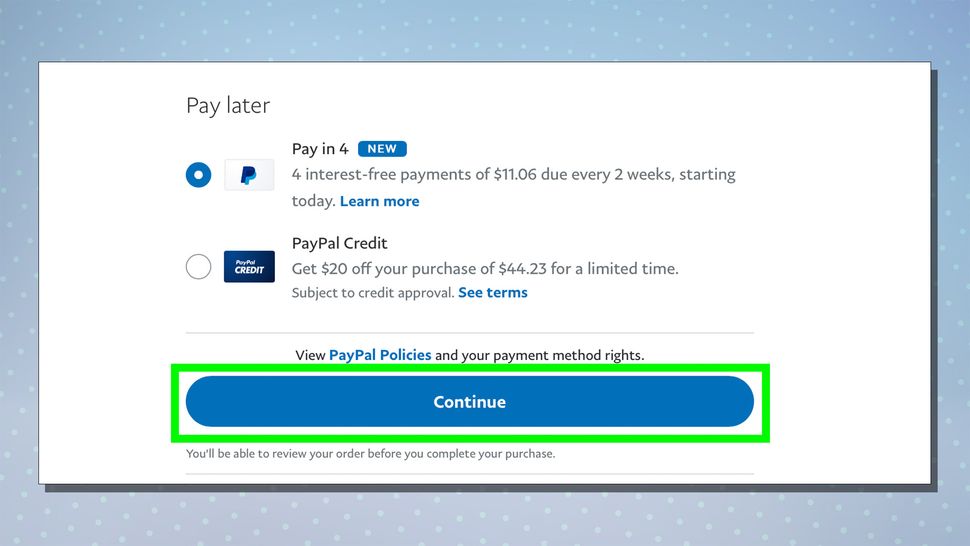

PayPal offers automatic repayments in 4 installments for loans. Check Why do I still owe money on my Pay in 4 loan? When you complete a purchase.By choosing PayPal Pay in 4 as your interest-free payment method when you check out with PayPal, you will pay your first installment at the time of purchase and.Apply for Pay in 4 without impacting your credit score. Peace of mind is built in. Enjoy Purchase Protection3 on your eligible items.

Pay in 4 is an interest-free installment loan that lets you split your purchase into 4 payments, with the down payment due at the time of the transaction. New customers may require a soft credit check for Pay in 4 or Pay Monthly, a process that usually takes only a few seconds. A sense of security. 1/3 of. Something comes odd here as PayPal Pay in 4 doesnt require a credit check. If anything they might do a soft pull, but that isnt always the case. Something comes odd here as PayPal Pay in 4 doesnt require a credit check. If anything they might do a soft pull, but that isnt always the case.

NM residents: Find more disclosures related to Pay in 4. When applying, a soft credit check may be needed, but will not affect your credit score. You must be PayPal will do a soft credit check using your information to determine your eligibility for financing. The soft credit check will NOT impact your credit score. If we assess your application for Pay in 4 by sharing information with a credit reporting body, that is a 'credit check', it will leave an imprint on your. When applying, a soft credit check may be needed, but will not affect your credit score. No. Applying for Pay in 4 will not impact your credit score. A soft credit check may be needed, but it will not affect your credit score.

You must be of legal age in your U.S. state of residence to use Pay in 4. Does Pay in 4 or Pay Monthly charge interest and fees? Pay in 4 is always interest-. Paypal's Pay in 4 was a great way for me to make purchases on my limited budget. I am no longer bidding on ebay due to their policy change. They have sort of. Note that when a shopper applies for a payment plan in Pay Later, PayPal conducts a credit check (soft check for Pay in 4 customers). The decision comes. PayPal's buy now, pay later services let you shop the Microsoft Store now and pay later with flexible installment options. Choose Pay in 4 for interest-free.